Condo Insurance in and around Worthington

Here's why you need condo unitowners insurance

State Farm can help you with condo insurance

Home Is Where Your Heart Is

There is much to consider, like deductibles coverage options, and more, when looking for the right condo insurance. With State Farm, this doesn't have to be an overwhelming decision. Not only is the coverage incredible, but it is also surprisingly well priced. And that's not all! The coverage can help provide protection for your condo and also your personal property inside, including things like souvenirs, sports equipment and appliances.

Here's why you need condo unitowners insurance

State Farm can help you with condo insurance

Protect Your Home Sweet Home

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your condominium from a hailstorm, fire or an ice storm.

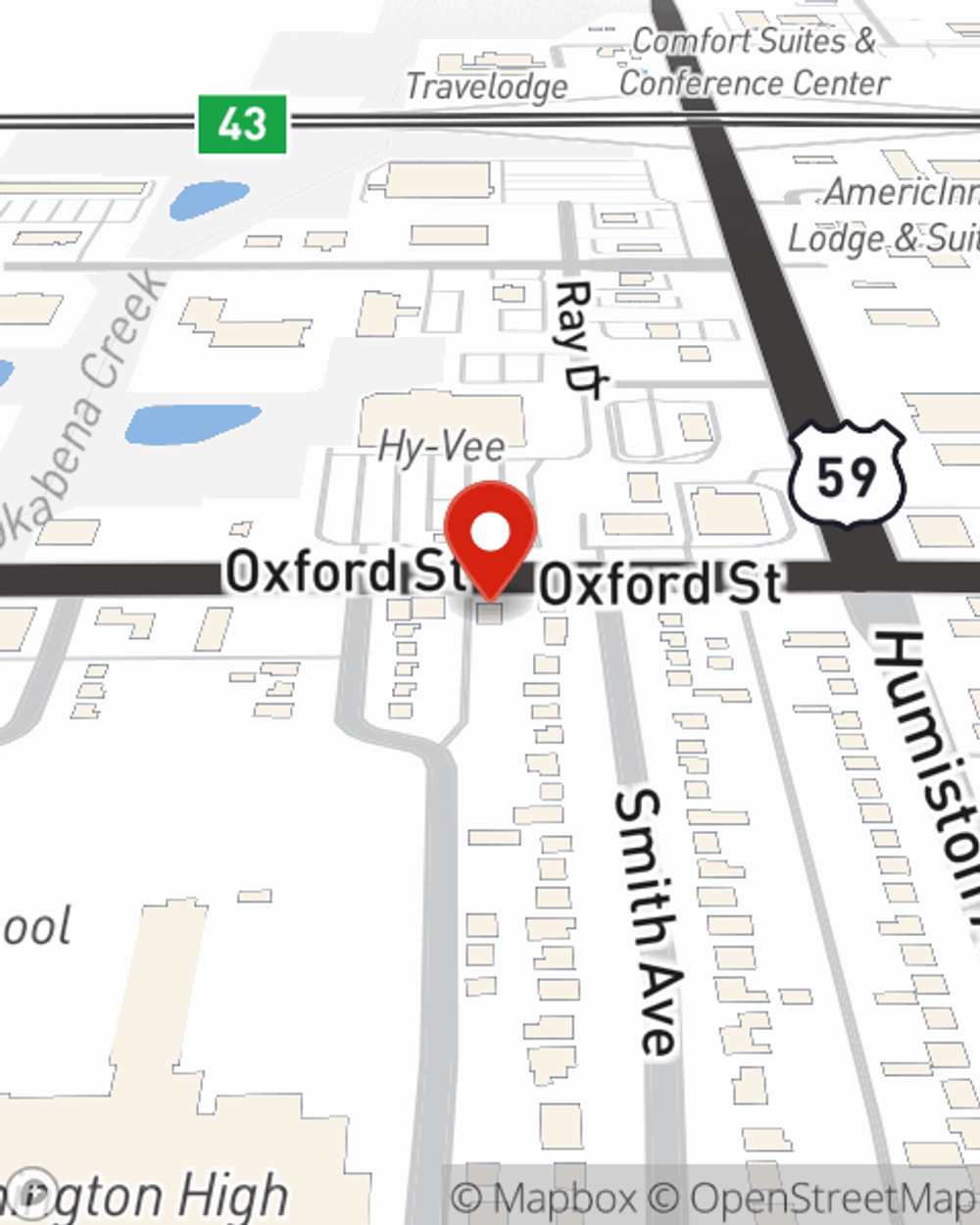

That’s why your friends and neighbors in Worthington turn to State Farm Agent Jessica Noble. Jessica Noble can outline your liabilities and help you find the most appropriate coverage for you.

Have More Questions About Condo Unitowners Insurance?

Call Jessica at (507) 372-2141 or visit our FAQ page.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

Jessica Noble

State Farm® Insurance AgentSimple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.