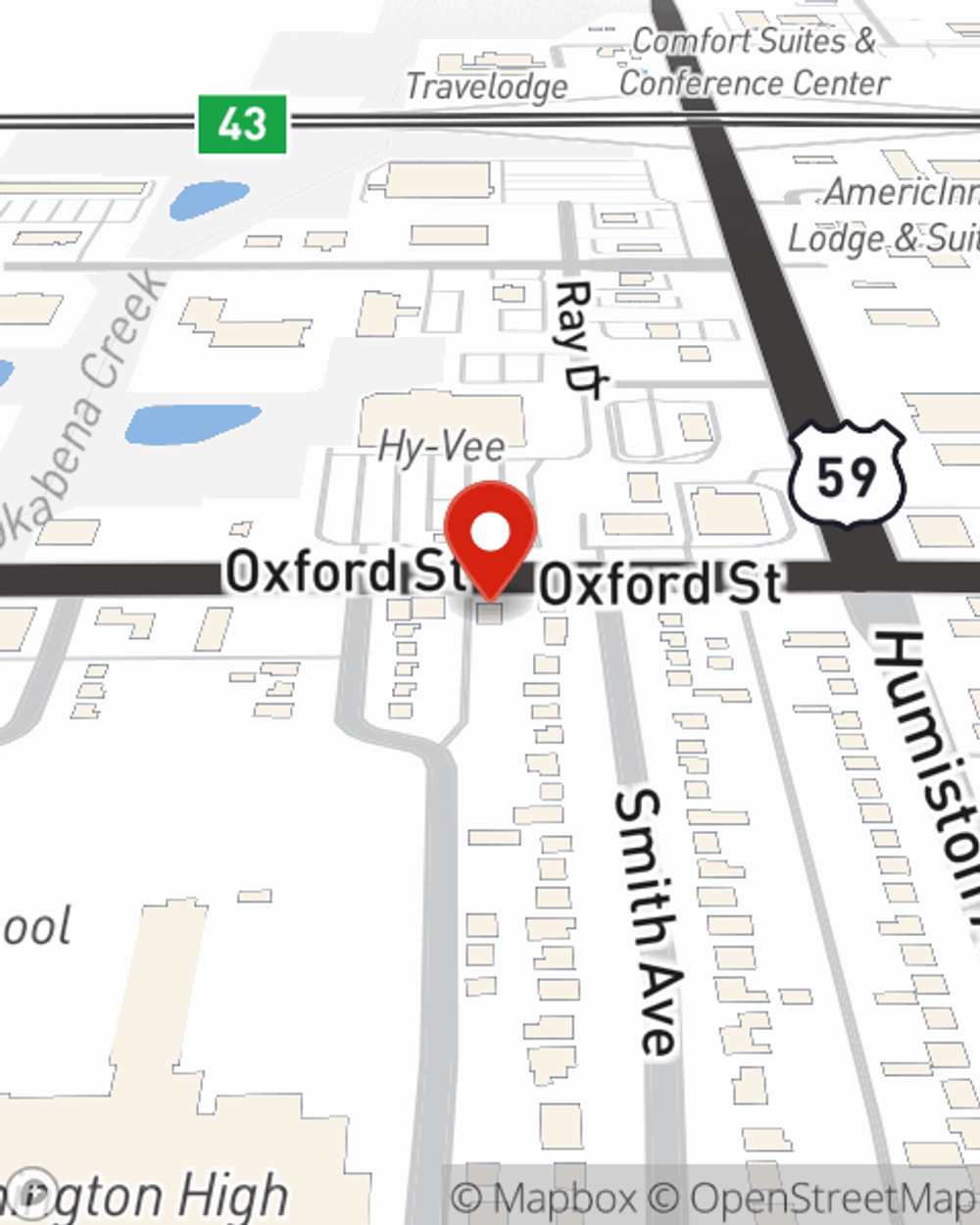

Business Insurance in and around Worthington

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Help Prepare Your Business For The Unexpected.

Owning a business is a 24/7 commitment. You want to make sure your business and everyone connected to it are covered in the event of some unexpected problem or catastrophe. And you also want to care for any staff and customers who hurt themselves on your property.

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Protect Your Future With State Farm

With options like worker's compensation for your employees, business continuity plans, extra liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent Jessica Noble is here to help you personalize your policy and can assist you in submitting a claim when the unexpected does occur.

Do what's right for your business, your employees, and your customers by reaching out to State Farm agent Jessica Noble today to discover your business insurance options!

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Jessica Noble

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.